Create High-Cost Filings

Use the following steps to create a high-cost filing.

Log in to the COTFA application.

Select High-Cost Filing from the navigation panel. The High-Cost Filings page appears.

Create High-Cost Filings

Select Create High-Cost. The Create High-Cost Filing pop-up window appears.

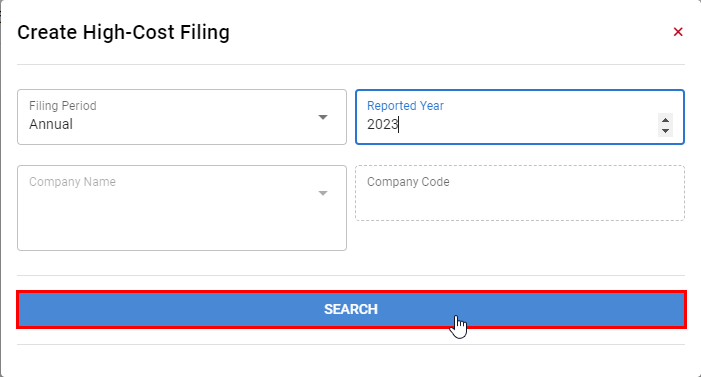

Search High-Cost Filings

Select the Filing Period (annual or semi-annual)

Select the Reported Year for which you want to file.

Company Name and Company Code cannot be changed.

Select Search to view any existing high-cost filings for the chosen filing period and year.

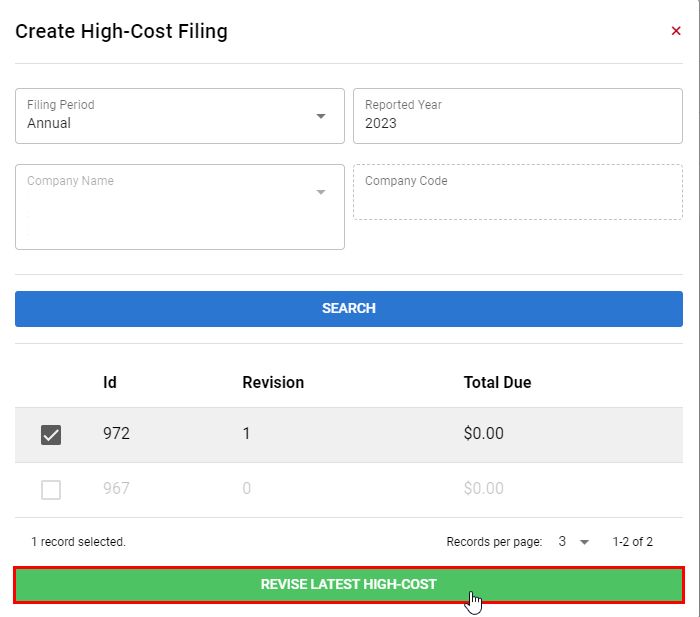

If there is an existing high cost filing for the chosen filing period and year, then it will appear below the Search button. Continue to step 7.

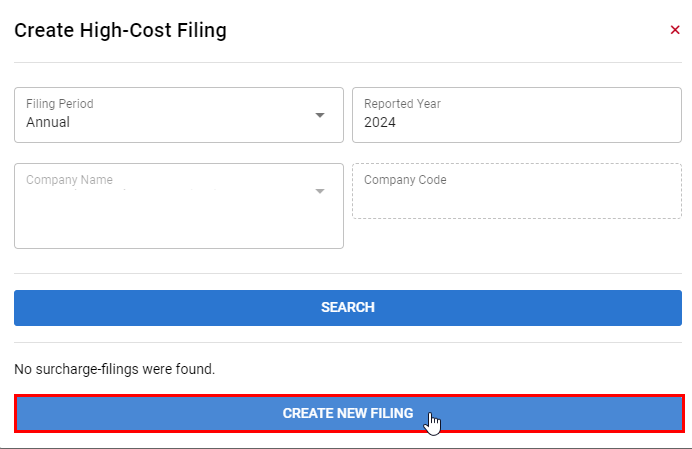

If there are no existing high cost filings, the message No surcharge filings were found appears below the Search button. Proceed to step 9.

Revise Latest High-Cost

Select the checkbox next to the existing high-cost filing you want to revise.

Select Revise Latest High-Cost to revise the selected existing high-cost filing.

Create New Filing

Select Create New Filing to create a new surcharge filing. The Create High-Cost Filing pop-up window appears.

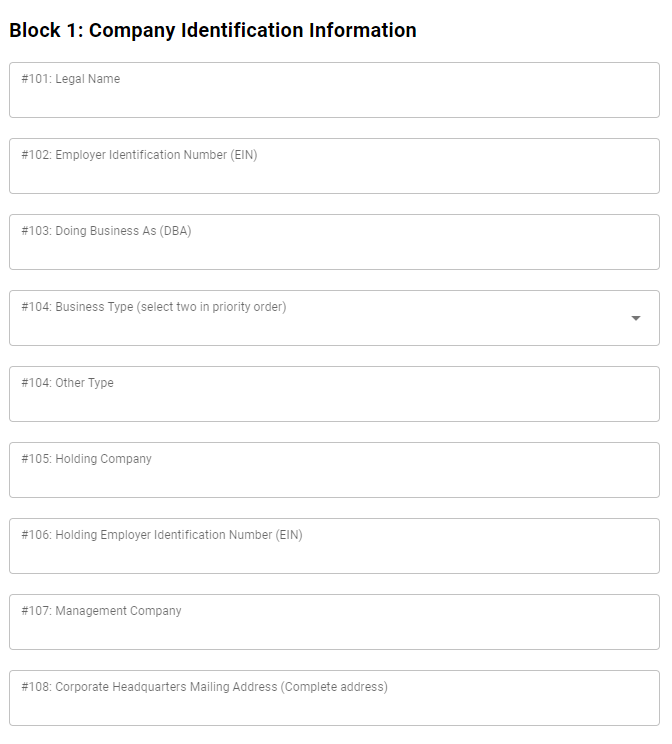

Block 1: Company Identification Information

Enter the following information for Block 1: Company Identification Information on the Create High- Cost Filing pop-up window.

* indicates a required field.

Field | Definition |

|---|---|

101: Legal Name* | The legal name of the reporting company as it appears on the Articles of Incorporation or other legal documents. |

102: Employer Identification Number (EIN)* | The Internal Revenue Service (IRS) employer identification number (EIN) for the company. If the company has more than one EIN, it should include the number used to file federal excise taxes. |

103: Doing Business As (DBA) | The principal name under which the company conducts telecommunications activities. This would typically be the name that appears on customer bills or is used when service representatives answer customer inquiries. |

104: Business Type (Select two in priority order) | Categories that best describe the company’s primary business |

CLEC/CAP | (Competitive Local Exchange Carrier/Competitive Access Provider). Competes with incumbent LECs to provide local exchange services or telecommunications services that link customers with interexchange facilities, local exchange networks, or other customers. |

Cellular/PCS/SMR | (Cellular, Personal Communications Service, and Specialized Mobile Radio service provider). Primarily provides wireless telecommunications services (wireless telephony). This category includes the provision of wireless telephony by resale. An SMR provider would select this category if it primarily provides wireless telephony rather than dispatch or other mobile services. |

Incumbent LEC (ILEC) | (Incumbent Local Exchange Carrier) Provides local exchange service. Generally is a carrier that was at one time franchised as a monopoly service provider. |

IXC | (Interexchange Carrier) Provides long-distance telecommunications services substantially through switches or circuits that it owns or leases. |

Local Reseller | Provides local exchange or fixed telecommunications services by reselling services of other carriers. |

OSP | (Operator Service Provider) Companies other than incumbent LECs that serve customers needing the assistance of an operator to complete calls, or needing alternate billing arrangements. |

Paging and Messaging | Provides wireless paging or wireless messaging services. This category includes the provision of paging and messaging services by resale. |

Payphone Service Provider | (aka pay telephone aggregators) Provides customers access to telephone networks through pay telephone equipment, equipment, etc. |

Pre-paid Card | Provides pre-paid calling card services by selling pre-paid calling cards to the public or to retailers. Pre-paid providers may resell the services of other carriers and determine the price of the service by setting the price of the card and may also control the number of minutes that the card can be used. |

Private Service Provider | Offers telecommunications to others for a fee which includes a company that offers excess capacity on a private (primarily internal purposes) system to others. |

Satellite | Provides satellite space segments or earth stations that are used for telecommunications services. |

Shared Tenant Service Provider | Manages or owns a multi-tenant location that provides telecommunication services or facilities to the tenants for a fee. |

SMR | (Specialized Mobile Radio service provider, dispatch). Primarily provides dispatch and mobile services other than wireless telephony. |

Toll Reseller | Provides long-distance telecommunications services primarily by reselling the long distance telecommunications services of other carriers. |

Wireless Data | Provides mobile or fixed wireless data services using wireless technology. This category includes the provision of wireless data services by resale. |

ISP Provider | Provides Dial-up and Dedicated Internet Service connection to the end-user. |

Other Local, Toll Mobile | If one of these categories is checked, the company should further describe the nature of the service it provides. For example, a company that provides network access services on behalf of a group of incumbent LECs would identify itself as "Other Local" and enter "incumbent LEC network access" in the space provided, or a company that provides interconnected fixed location VOIP services in accordance with a Commission Decision would identify itself as "Other Local" and describe itself. |

104: Other Type | A business type not listed above. |

105: Holding Company | The name of the company's holding company or controlling entity, if any. All affiliates or commonly controlled companies should have the same name appearing on Line (105). An affiliate is a "person that (directly or indirectly) owns or controls, is owned or controlled by, or is under common ownership or control with, another person." |

106: Holding Employer Identification Number (EIN) | The company's holding company’s IRS employer identification number. |

107: Management Company | The name of the management company, if the company is managed by an entity other than itself. If the filing company and at least one other company are commonly managed, then each should show the same management company. Companies need not be affiliated to have a common management company. The management company would typically be the point of contact for the CHCSM Administrator. |

108: Corporate Headquarters Mailing Address* | The complete mailing address of the corporate headquarters. |

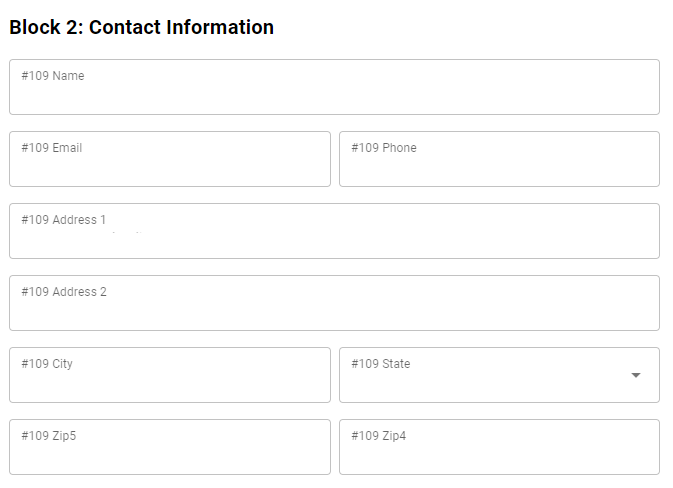

Block 2: Contact Information

Enter the following information for Block 2: Contact Information on the Create High Cost Filing pop-up window.

* indicates a required field.

Field | Definition |

|---|---|

109: Legal Name* | The contact name of the person who can provide clarifications, additional information, and if necessary, who could serve as the first point of contact if either the Commission or the CHCSM Administrator has questions on or choose to audit this CHCSM filing. |

109: Email* | The e-mail address of the person who can provide clarifications, additional information, and if necessary, who could serve as the first point of contact if either the Commission or the CHCSM Administrator has questions on or choose to audit this CHCSM filing. |

109: Phone* | The phone number of the person who can provide clarifications, additional information, and if necessary, who could serve as the first point of contact if either the Commission or the CHCSM Administrator has questions on or choose to audit this CHCSM filing. |

109: Address 1* | Street address of the contact person |

109: Address 2 | Continued street address (building, unit, or suite number, if applicable) of the contact person |

109: City* | City of the contact person |

109: State* | State of the contact person |

109: Zip Code* | Zip code of the contact person |

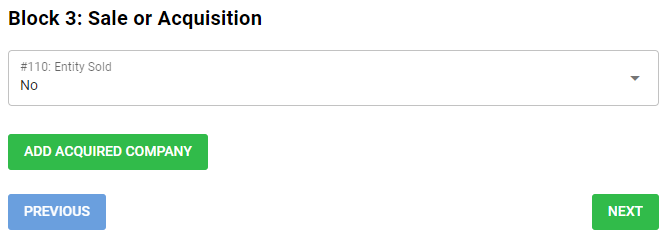

Block 3: Sale or Acquisition

Select yes or no on the 110 Entity Sold drop-down list under Block 3: Sale of Acquisition on the Create High Cost Filing pop-up window.

If the entity was not sold during the current year, select No.

If you acquired a company during the current year, select Add Acquired Company.

Select the Date Acquired.

Enter the name of the Acquired Company.

If the entity was sold during the current year, select Yes.

Select the Date of Sale.

Enter the name of the entity to which the entity listed in Field 101 was sold.

Select Next. The Block 5: Contributor Revenue Information pop-up window appears.

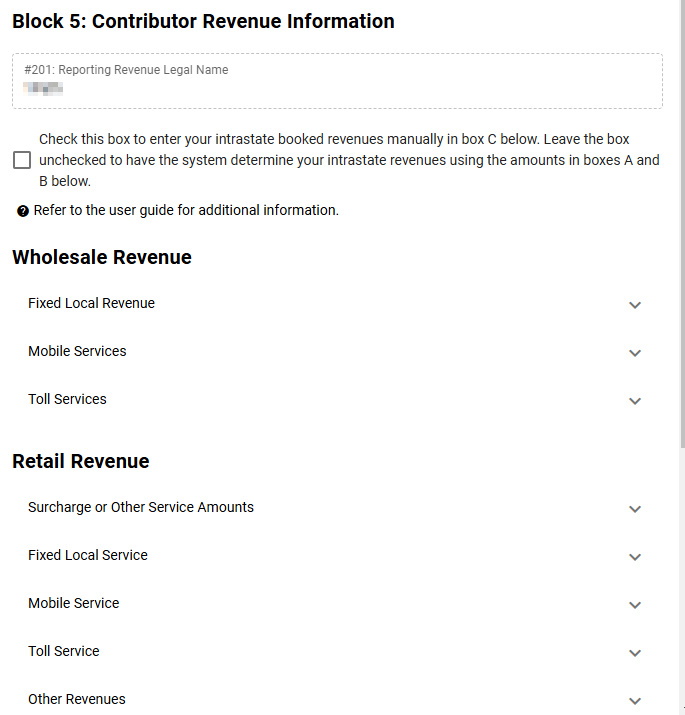

Block 5: Contributor Revenue Information

Do one of the following:

Leave the checkbox unchecked to have the system determine your intrastate revenues using the amounts in the (a) and (b) boxes.

Select the checkbox to enter your intrastate booked revenues manually in (a) and (c) boxes and have the amounts in (b) boxes auto-populate.

If the box is left unchecked, (c) boxes are auto-populated based on the calculation (c) = (a) * (b).

Use the information in the table below to complete Block 5: Contributor Revenue Information.

Wholesale Revenue | ||

Fixed Local Revenue | ||

203: Local Exchange Service | ||

|

| |

203a: Unbundled Network Element | ||

Field | Definition | Input |

(a) Total Revenue | Total revenue provided as unbundled network elements | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if checkbox in step 16 is left unchecked. Auto-populated/no input needed if checkbox is checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

203b: Under Tariff | ||

Field | Definition | Input |

(a) Total Revenue | Total revenue provided under tariffs or arrangements other than unbundled network elements | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if checkbox in step 16 is left unchecked. Auto-populated/no input needed if checkbox is checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

204: Per Minute Charges | ||

Per-minute charges for originating or terminating calls should include:

| ||

204a: State or Federal Access Tariffs | ||

Field | Definition | Input |

(a) Total Revenue | Total revenue provided under state or federal access tariffs | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if checkbox in step 16 is left unchecked. Auto-populated/no input needed if checkbox is checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

204b: Unbundled Network Elements | ||

Field | Definition | Input |

(a) Total Revenue | Total revenue provided as unbundled network elements or other contractual arrangements | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

205: Local Private Line and Special Access Services | ||

Field | Definition | Input |

(a) Total Revenue | Total revenues from:

| ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

206: Payphone Compensation From Toll Carriers | ||

Field | Definition | Input |

(a) Total Revenue |

| ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

207: Other Local Telecommunication Services Revenue | ||

Field | Definition | Input |

(a) Total Revenue | Total revenue from:

| ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

208: Universal Services Support Revenues | ||

Field | Definition | Input |

(a) Total Revenue | Total revenue from:

| ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

Mobile Services | ||

209: Monthly Activation and Message Charges Except Tolls | ||

Field | Definition | Input |

(a) Total Revenue | Total revenue from:

| ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

Toll Services | ||

210: Operator and Toll Calls with Alternative Billing Arrangements | ||

Field | Definition | Input |

(a) Total Revenue | Total revenue from:

| ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

211: Other Switched Toll Services | ||

Field | Definition | Input |

(a) Total Revenue | Amounts from Account 5100 - Long Distance Message Revenue - except for amounts reported on Lines (210), (223), or (225) | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

212: Ordinary Long Distance | ||

Field | Definition | Input |

(a) Total Revenue | Total revenue from:

| ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

213: Satellite Services | ||

Field | Definition | Input |

(a) Total Revenue | Total revenue from providing space segment service and earth station up-link capacity used for providing telecommunications or telecommunications services via satellite | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

214: All Other Long Distance Services | ||

Field | Definition | Input |

(a) Total Revenue |

| ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

Retail Revenue | ||

Surcharge or Other Service Amounts | ||

215: Surcharge or Other Amounts on End-User Bills Distance Services | ||

Field | Definition | Input |

(a) Total Revenue | The total amount shown on FCC Form 499A. Includes:

| ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

Fixed Local Service | ||

216: Monthly Services and Other Local Exchange Services | ||

216a: Provide as Flat Rate Including Intrastate Toll Service | ||

Field | Definition | Input |

(a) Total Revenue | End-user revenues from field 203 including intrastate toll service | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

216b: Provide Without Intrastate Toll Included | ||

Field | Definition | Input |

(a) Total Revenue | End-user revenues from field 203 without intrastate toll service | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

217: End User Charges | ||

217a: Tariff Subscriber List Charges to End Users | ||

Field | Definition | Input |

(a) Total Revenue | Total revenue from:

| ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

217b: Access Recovery Charge | ||

Field | Definition | Input |

(a) Total Revenue | ex: 125.25 | |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

218: Local Private Line and Special Access Line | ||

Field | Definition | Input |

(a) Total Revenue | End-user revenues from field 205 | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

219: Pay Telephone Coin Revenues | ||

Field | Definition | Input |

(a) Total Revenue | Revenues paid directly to the payphone service provider | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

220: Other Local Telecommunication Services | ||

Field | Definition | Input |

(a) Total Revenue | End-user revenues from field 207 | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

Mobile Service | ||

221: Monthly Charges and Activation Charges | ||

Field | Definition | Input |

(a) Total Revenue | Total revenue from:

| ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

222: Message Charges Roaming Exclude Toll Charges | ||

Field | Definition | Input |

(a) Total Revenue | Total revenue from:

| ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

223: Prepaid Mobile Service Calling Charges Reported Face-Value of Cards | ||

Field | Definition | Input |

(a) Total Revenue | Revenues from pre-paid calling cards provided either to customers or to retail establishments **Gross billed revenues should represent the amounts actually paid by customers for the cards without any reduction or adjustment for discounts provided to retail establishments. | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

Toll Service | ||

224: Prepaid Toll Calling Charges Reported at Face-Value of Cards | ||

Field | Definition | Input |

(a) Total Revenue | Revenues from pre-paid toll calling cards provided either to customers or to retail establishments **Gross billed revenues should represent the amounts actually paid by customers for the cards without any reduction or adjustment for discounts provided to retail establishments. | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

225: Operator and Toll Calls with Alternative Billing Arrangements | ||

Field | Definition | Input |

(a) Total Revenue | End-user revenues from field 210 | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

226: Other Switch Toll Service | ||

Field | Definition | Input |

(a) Total Revenue |

| ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

227: Long Distance Private Line | ||

Field | Definition | Input |

(a) Total Revenue | End-user revenues from field 212 | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

228: Satellite Services | ||

Field | Definition | Input |

(a) Total Revenue | End-user revenues from field 213 | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

229: All Other Long Distance Services | ||

Field | Definition | Input |

(a) Total Revenue | End-user revenues from field 214 | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

Other Revenues | ||

230: Non-telecommunications Products and Service Revenues | ||

Field | Definition | Input |

(a) Total Revenue | Total revenue from:

| ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

231: Misc. Revenues | ||

Field | Definition | Input |

(a) Total Revenue | Any revenues in Account 5230 - Directory revenue | ex: 125.25 |

(b) Percentage Intrastate | Percentage of Total Revenue that are for Colorado intrastate service | Whole numbers 0-100 if box in step 16 left unchecked. Auto-populated/no input if box checked. |

(c) Intrastate Revenue | Gross Total Revenue multiplied by Percentage Interstate | Auto-populated/no input needed if checkbox in step 16 is left unchecked. Two decimal places if checkbox is checked. |

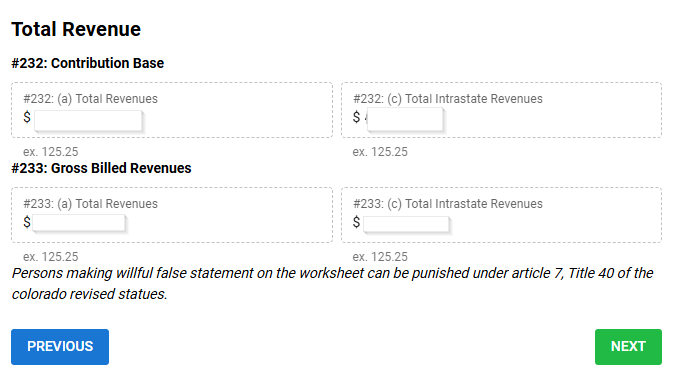

Total Revenue

All fields under Total Revenue will be auto-populated based on your inputs for all fields above.

Select Next. The Block 4: CHCSM Declaration and Certification pop-up window appears.

If you get the error message, Please address the errors on the page before proceeding, then verify that all values in (b) boxes are within the 0-100 range.

CHCSM Declaration and Certification

Enter the following information for Block 4: CHCSM Declaration and Certification on the Create High-Cost Filing pop-up window.

* indicates a required field.

Field | Definition |

|---|---|

113: Prepared Name* | Name of the person preparing the return on behalf of the company indicated above |

Prepared Email* | Email of the person preparing the return on behalf of the company indicated above |

Prepared Phone Number* | Phone number of the person preparing the return on behalf of the company indicated above |

114: Prepared Title* | Title of the person preparing the return on behalf of the company indicated above |

115: Prepared Date* | Date the filing was prepared |

Check the box affirming that the information provided is correct and that you have the authority to submit the return on behalf of the company indicated above.

Select Submit. The message High Cost filing was created appears in green at the bottom of the page.